-

Recent Posts

- Jamie Dimon’s worst fears for the banking industry realized with Capital One data hack

- Diary of a Deutsche Bank stock trader: The day I lost my job

- CFPB claims debt collection firm Forster & Garbus robo-sued thousands on behalf of Citibank, Discover, others

- Countrywide founder Angelo Mozilo says ‘for some unknown reason, I got blamed’ for subprime crisis

- New York launches its own CFPB

Archives

- August 2019

- July 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

Categories

Justice League Site Meter

SP Biloxi

-

Join 3,444 other subscribers

Justice League Task Force

May 2024 M T W T F S S 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 Blogroll

- American Banker

- Bankruptcy & Foreclosure

- Committee on Oversight and Government Reform

- Courthouse News

- Credit Slips

- Deadly Clear

- Discuss

- DOJ Justice Blog

- Dr. Lan T. Pham Economics Voodoo

- Get Inspired

- Get Polling

- Get Support

- ICIJ

- iWatch News

- Learn WordPress.com

- Legal Times

- Main Justice

- National Mortgage Settlement

- Newsbud

- Project On Government Oversight

- REFinBlog

- Reuters Legal

- SCOTUSblog

- Terri Buhl

- The Consumer Financial Protection Bureau

- The Housing Justice Foundation

- The Public Record

- Theme Showcase

- Truthout

- White Collar Crime Prof Blog

- White House Schedule

- WordPress Planet

- WordPress.com News

Justice League Tag Cloud

AIG bank Bank of America bankruptcy Banks Barclays Bear Stearns CFPB Citigroup class action Countrywide Credit Suisse debt collectors Derivatives Deutsche Bank Dodd-Frank law DOJ Fannie Mae FDIC Federal Reserve FHA FHFA foreclosure foreclosure review Foreclosure settlement Freddie Mac Goldman Sachs HAMP hedge fund homeowner homeowners Housing HSBC HUD investors Jamie Dimon JP Morgan Chase Lehman Brothers LIBOR loan modification loans London Whale MBS MERS money laundering Monsack Fonseca Morgan Stanley Mortgage mortgage fraud mortgage servicers National Mortgage Settlement Nationstar New York Attorney General Ocwen Office of the Comptroller of the Currency Offshore accounts predatory lending RBS RMBS robo-signing SEC Securitization shareholder shareholders subprime tax haven TBIF TBTF UBS US Bank US Treasury Wall Street WAMU Wells Fargo whistleblowerPoll of the Week

-

Join 3,444 other subscribers

Tag Archives: robosigning

J.P. Morgan to Settle Credit-Card Probes for $125 Million–Sources

J.P. Morgan Chase & Co. intends to pay at least $125 million to settle probes by U.S. state and federal authorities over the New York bank’s collection and sale of credit-card debt, people familiar with the matter said.

The settlement, the latest by regulators to crack down on credit-card and debt-collection abuses, also includes about $50 million in restitution, the people said.

J.P. Morgan, the largest U.S. bank by assets, has been accused of relying on robosigning and other methods of collecting debt from consumers that they may not have owed and providing inaccurate information to debt buyers, an area regulators have scrutinized in recent years across several financial-services firms.

Servicers in DOJ’s Crosshairs Following JPM Robo-Signing Settlement

Mortgage servicers were supposed to have stopped robo-signing foreclosure documents when state and federal authorities cracked down on the practice years ago, but it seems some have not learned their lesson.

While only JPMorgan Chase has been cited for recent robo-signing infractions, Clifford J. White 3rd, the head of a Justice program that oversees consumer bankruptcies, says he is seeing evidence of other servicers not following proper protocols when it comes to dealing with homeowners who have filed for bankruptcy. That could include not just robo-signing documents, but also failing to inform homeowners of mortgage payment increases or charging excessive loan-default fees.

Such abuses violate a 2012 settlement between law enforcement officials and the nation’s largest servicers and White is putting other servicers on notice that they too will be punished if they flout bankruptcy rules.

“Compared to where we were a few years ago, the banks are doing a better job,” said White, the director the Justice Department’s Office for U.S. Trustees. But, he added, “it is disappointing that, after all the years, [the problems]…are not completely rectified.”

Hammond couple sue Green Tree, JP Morgan, Bank of NY Mellon, and Ocwen over ‘robosigning’ and TILA

A Hammond couple claim in a federal lawsuit that they were victims of “robosigning” and other predatory mortgage practices that left them facing foreclosure.

According to the lawsuit, which was filed in Lake County Superior Court a month ago and was moved to U.S. District Court in Hammond on Tuesday, Pedro and Elisa Rico bought their Hammond house in 1996.

The couple were up to date on their payments, but their lender, Green Tree Servicing, LLC, approached them about refinancing in 1999.

The lawsuit says Green Tree used their son, who was a minor at the time, to translate the terms of the new loan for them, which they thought included a fixed rate over 15 years.

The Ricos say they didn’t learn until a year ago when they received a notice that it actually included a balloon payment of $40,000 due in August 2014.

The Ricos are claiming Green Tree and Bank One used other deceptive practices, such as having documents signed by a notary when they weren’t there and providing false information for Elisa Rico to join the deed on the house so the couple would qualify.

And here is information on the Rico’s lawsuit. Case number 2:2015cv00089:

Rico et al v. Green Tree Servicing, LLC et al

| Plaintiff: | Pedro F. Rico and Elisa F. Rico |

|---|---|

| Defendant: | Green Tree Servicing, LLC, J.P. Morgan Chase Bank, N.A., Bank of New York Mellon and OCWEN Loan Servicing, LLC |

| Case Number: | 2:2015cv00089 |

|---|---|

| Filed: | March 10, 2015 |

| Court: | Indiana Northern District Court |

|---|---|

| Office: | Hammond Office |

| County: | Lake |

| Referring Judge: | John E Martin |

|---|---|

| Presiding Judge: | Joseph S Van Bokkelen |

| Nature of Suit: | Truth in Lending |

|---|---|

| Cause of Action: | 28:1441 Petition for Removal |

| Jury Demanded By: | Plaintiff |

Posted in Uncategorized

Tagged Bank of NY Mellon, foreclosure, Green Tree, JP Morgan Chase, Ocwen, robosigning, TILA

DOJ fines JPMorgan Chase $50 million for robo-signing

Chase admits to misfiling mortgage documents

JPMorgan Chase (JPM) admitted to misfiling more than 50,000 payment change notices in bankruptcy courts that were “improperly signed, under penalty of perjury, by persons who had not reviewed the accuracy of the notices,” and will pay more than $50 million to homeowners as part of a settlement with the U.S. Department of Justice over its mortgage practices.

The DOJ announced Tuesday that it reached a settlement agreement with Chase, under which Chase admits that more than 25,000 of the 50,000 fraudulent notices were signed in the names of former employees or of employees who had nothing to do with reviewing the accuracy of the filings.

The rest of the notices were signed by individuals employed by a third party vendor on matters unrelated to checking the accuracy of the filings, the DOJ also said.

“It is shocking that the conduct admitted to by Chase in this settlement, including the filing of tens of thousands of documents in court that never had been reviewed by the people who attested to their accuracy, continued as long as it did,” said Acting Associate Attorney General Stuart Delery.

“Such unlawful and abusive banking practices can deprive American homeowners of a fair chance in the bankruptcy system, and we will not tolerate them.”

JPMorgan Chase responded to the DOJ’s statement announcing the settlement and took issue with the DOJ’s choice of phrase.

“We do not think it is accurate to characterize as ‘robo-signing’ a process in which a bank employee reviewed the accuracy of the information in each payment change notice. Here, bank employees reviewed the accuracy of the information in the 50,000 PCNs and the notices were accurate over 99% of the time,” Chase Vice President and Head of External Communications Jason Lobo said.

…………………………….

Under the terms of the settlement agreement, Chase will pay more than $50 million to more than 25,000 homeowners who are currently or previously were in bankruptcy. The payments will be made in the form of cash payments, mortgage loan credits and loan forgiveness, including:

- $22.4 million in credits and second lien forgiveness to about 400 homeowners who received inaccurate payment increase notices during their bankruptcy cases

- $10.8 million to more than 12,000 homeowners in bankruptcy through credits or refunds for payment increases or decreases that were not timely filed in bankruptcy court and noticed to the homeowners

- $4.8 million to more than 18,000 homeowners who did not receive accurate and timely escrow statements. This includes credits for taxes and insurance owed by the homeowners and paid by Chase during periods covered by escrow statements that were not timely filed and transmitted to homeowners

- $4.9 million, through payment of approximately $600 per loan, to more than 8,000 homeowners whose escrow Chase may have applied in a manner inconsistent with escrow statements it provided to the homeowners

- $7.5 million to the American Bankruptcy Institute’s endowment for financial education and support for the Credit Abuse Resistance Education Program

Maine supreme court justice reverses reprimand of Portland lawyer in connection with foreclosure ‘robo-signing’ scandal

PORTLAND, Maine — A Maine Supreme Judicial Court judge has reversed and dismissed the public reprimand of a Portland lawyer in connection with the foreclosure “robo-signing” scandal.

Justice Andrew Mead said in his 12-page decision dated Thursday, Jan. 15, that a three-member panel of the Maine Board of Overseers of the Bar incorrectly found that Paul E. Peck of Portland had violated bar rules in 2010 because he did not “take immediate and effective action” to stop foreclosure proceedings that were based on faulty affidavits.

“[The] panel’s decision is founded upon a ‘should have known’ standard rather than actual knowledge,” Mead wrote. “The distinction is critical.”

The judge said the rules the panel concluded Peck had violated “are clearly predicated upon conscious malfeasance, not negligence or recklessness.”

The board of overseers issued its reprimand on April 10. Peck, who works for the law firm Drummond & Drummond , immediately appealed it to the state supreme court and it was assigned to Mead.

“The panel issued the lowest level of discipline that is available if they are going to issue discipline,” James Bowie, Peck’s Portland attorney, told the Bangor Daily News in June. “Despite that, we feel the factual findings don’t support the imposition of any discipline at all.”

Borrowers, Beware: The Robo-signers Aren’t Finished Yet

Remember the robo-signers, those mortgage loan automatons who authenticated thousands of foreclosure documents over the years without verifying the information they were swearing to?

Well, they’re back, in a manner of speaking, at least in Florida. Their dubious documents are being used to hound former borrowers years after their homes went into foreclosure.

Robo-signer redux, as it might be called, has come about because of an aggressive pursuit of former borrowers by debt collectors hired by Fannie Mae, the mortgage finance giant. What Fannie is trying to recoup from these borrowers is the difference between what the borrowers owed on the mortgages when they were foreclosed and the amount Fannie received when it resold the properties.

These monetary amounts — and they can be significant — are known as deficiency judgments. It is legal in most states for lenders to pursue them. (California is one notable exception.) The time limit for debt collectors to go after former borrowers varies from state to state; Florida allows deficiencies to be pursued for 20 years, and borrowers must pay a compounded annual interest rate of 4.5 percent.

The problem, experts say, arises when robo-signed documents enabled banks to foreclose even when they didn’t have legal standing to do so.

“Sending these cases to debt collectors when the underlying foreclosures involved unlawful robo-signing is unfair and potentially even deceptive,” said Kathleen C. Engel, a research professor at Suffolk University Law School in Boston. “Fannie Mae is not entitled to collect on those debts when the foreclosure was unlawful.”

A Fannie Mae spokesman, Andrew J. Wilson, declined to comment on Ms. Engel’s contention. But he said Fannie filed deficiencies “in a minority of cases where there was a foreclosure.” He acknowledged, however, that Fannie was bringing several thousand cases in Florida because of a recent state law requiring that any such borrower suits be filed by July 1 of this year.

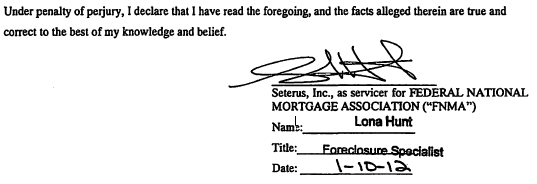

ROBO-VERIFIER LONA HUNT ADMITS, TWICE, TO NOT READING FORECLOSURE COMPLAINT BEFORE SIGNING UNDER PENALTY OF PERJURY

Hat tip from 4closurefraud website:

Cross-posted from The Law Offices of Evan M. Rosen

The entire reasoning behind the Florida Supreme court taking unprecedented, historic action to amend rule 1.100(b) back in 2011 was because of the financial industry’s well documented illegal behavior. It was enacted around the time that the “robo signing” scandal had broken wide open. We now know that “robo-signing” is used to describe the process of having a person sign a document without authority to do so and/or knowledge as to that which she/he is signing, despite swearing otherwise. The “robo-signing” scandal set off a nation-wide foreclosure moratorium and ultimately led to settlements with 49 states, Office of the Comptroller of the Currency consent orders, and numerous class action and shareholder lawsuits. Mortgage foreclosure related settlements with Ocwen, LPS, Chase and others continue to roll in. Yet, no matter the amount and severity of lawsuits, settlements, and bad publicity, it appears, at least in this case, that the act of signing without proper authority or knowledge as to that which one is signing, continues. Ms. Hunt freely admitted, twice, to not reading the foreclosure complaint before signing it. Further, with her limited knowledge, it was impossible for her to truthfully and accurately verify all the facts alleged in the complaint.

Fla. R. Civ. P. 1.110(b) states in relevant part:

When filing an action for foreclosure of a mortgage on residential real property the complaint shall be verified. When verification of a document is required, the document shall include an oath, affirmation, or the following statement: “Under penalty of perjury, I declare that I have read the foregoing, and the facts alleged therein are true and correct to the best of my knowledge and belief.”

The complaint in this case contained the above quoted language and was signed by Lona Hunt, Foreclosure Specialist for Seterus, Inc., the alleged servicer and foreclosure arm for Plaintiff, Federal National Mortgage Association (Fannie Mae).

The deposition of Lona Hunt took place on October 17, 2014, during which time Ms. Hunt was questioned about her knowledge of the truth and accuracy of the facts in the foreclosure complaint, which she allegedly verified. During the deposition, Ms. Hunt admitted twice that she did not read the complaint, even though she swore in the complaint,under penalty of perjury, that she had.

Mr. Rosen: Q. Let’s take a look at the complaint. First of all, before you signed, did you read the complaint?

Lona Hunt: A. No

(Hunt Depo, P. 43 Ln. 10-13).

Later, when questioned by Plaintiff’s counsel, Ms. Hunt again admitted to not reading the complaint.

P’s Counsel: Q. Okay. Now, when you received that complaint, the draft to review for execution, did you read it first?

Lona Hunt: A. No.

(Hunt Depo, P. 55 Ln. 18-21).

It is clear that the witness understood the question posed and answered truthfully; she did not read the complaint before signing the verification. At the beginning of the deposition, Defendants’ counsel advised Ms. Hunt to verbalize when she didn’t understand a question and Ms. Hunt agreed. (Hunt Depo, P. 13 Ln. 19-25). At least twenty-three times during the relatively short deposition, Ms. Hunt stated that she either did not understand certain questions or asked counsel to repeat. (Hunt Depo, P. 8 Ln. 10, P. 9 Ln. 21, P. 11 Ln. 4, P. 19 Ln. 15, P. 20 Ln. 11, P. 20 Ln. 17, P. 22 Ln. 6, P. 22 Ln. 18, P. 25 Ln. 23, P. 26 Ln. 23, P. 31 Ln. 18, P. 38 Ln. 1, P. 42 Ln. 12, P. 42 Ln. 24, P. 44 Ln. 5, P. 44 Ln. 9, P. 45 Ln. 11, P. 48 Ln. 24, P. 52 Ln. 2, P. 53 Ln. 10, P. 53, Ln. 16, P. 57 Ln. 9, P. 59 Ln. 3). However, when asked if she read the complaint, once by Defense counsel and once by Plaintiff’s counsel, Ms. Hunt did not need clarification and did not hesitate to answer. The answer and the truth came right out.

Plaintiff’s counsel then lead Ms. Hunt to agree that she had read it as she was going through to “verify the various facts.”

P’s Counsel: Q. Did you read it as you were going through to verify the various facts that are set forth in the complaint?

. . .

Lona Hunt: A. Yes.

(Hunt Depo. P. 55 Ln. 22 – Pg. 56 Ln. 3)

Ms. Hunt’s agreement that she read it as she was going through to “verify the various facts” related only to the fact thatMs. Hunt scanned the complaint to verify Defendant’s name, the county, the UPB, and the date of default.

Mr. Rosen: Q. What is it that you were looking for to compare between the verified complaint and what was on the computer?

Lona Hunt: A. Defendant’s name, the county.

. . .

Mr. Rosen: Q. The defendant’s name, the county?

Lona Hunt: A. The UPB and the date.

Mr. Rosen: Q. And that’s the date of?

Lona Hunt: A. The default.

Mr. Rosen: Q. Okay. Anything else that you were looking at between the verified complaint and what was on the computer screen?

. . .

Lona Hunt: A. No.

Mr. Rosen: Q. What was on the computer screen?

Lona Hunt: A. Their loan number, their name, their address, their UPB and the default date.

Mr. Rosen: Q. And was that through that PULS system as well?

Lona Hunt: A. Yes

(Hunt Depo, P. 36 Ln. 15 – P. 37 Ln. 16).

Mr. Rosen: Q. Was there anything else you looked at other than the PULS report when also looking at the complaint?

. . .

Lona Hunt: A. The note and mortgage.

Mr. Rosen: Q. Anything else?

Lona Hunt: A. No.

(Hunt Depo, P. 38 Ln. 3-10).

Even if Ms. Hunt had read the complaint before signing it, she admitted that she could not verify the truth and accuracy of the alleged facts in paragraphs 1, 2, 3, 4, 5, 6, 8, 9, and 10 as well as in the “wherefore” clause of the Complaint. Although Ms. Hunt signed the verification on the Complaint under penalty of perjury and swore that all of the factsalleged in the Complaint were true and correct to the best of her knowledge and belief, she admitted numerous times in her deposition that she did not know the facts she was verifying, did not understand the words used in the complaint, and/or could not accurately describe where the information for those facts came from.

The Complaint and Ms. Hunt’s testimony are as follows, respectively.

Paragraph 1 of Complaint states “. . . All conditions precedent to the filing of this matter have been completed and/or waived.” Ms. Hunt admitted that she did not know what this meant:

Mr. Rosen: Q. And also in paragraph 1 there is the word “condition precedent.” What does condition precedent mean?

. . .

Lona Hunt: A. I’m not sure.

. . .

Mr. Rosen: Q. I just want to know if you know what that means?

Lona Hunt: A. I don’t understand, no.

Mr. Rosen: Q. Okay. You understand my question, you just don’t understand what condition precedent means, is that what you’re saying?

Lona Hunt: A. Yes.

Mr. Rosen: Q. How did you know, if at all, whether or not conditions precedent to the filing of this matter had been completed or waived, if you knew?

. . .

Lona Hunt: A. I didn’t know. I don’t know.

(Hunt Depo, P. 43 Ln. 20 – P. 45 Ln. 3).

Paragraph 2 of the Complaint states that “[t]he subject-property is owned by Defendant(s), Redacted, who hold(s) possession.” Ms. Hunt’s testimony regarding paragraph 2 reveals that she is not familiar with very the basic principles of Plaintiff’s business, such as ownership of property, as she could not properly identify the document which indicated that Defendant was the record owner of the subject property.

Mr. Rosen: Q. Okay. In paragraph 2 it says subject property owned by defendant Redacted. How do you know that or do you know that?

Lona Hunt: A. The mortgage and the note.

Mr. Rosen: Q. And something in the mortgage and note tells you that they own – that Redacted owns the subject property?

. . .

Lona Hunt: A. Yes

(Hunt Depo, P. 45 Ln. 4-15).

Paragraph 3 of the Complaint states that unknown tenants in possession may claim an interest in the subject property by virtue of possession or occupancy; however their claims are subordinate, junior and inferior to the Plaintiff’s interests. Ms. Hunt admitted that she did not know if tenants were in possession and further did not know what it meant to be subordinate, junior or inferior to Plaintiff’s lien. After reading paragraph 3, Ms. Hunt was asked:

Mr. Rosen: Q. Did you know if that was the case that there were any tenants in possession of the property?

Lona Hunt: A. No.

Mr. Rosen: Q. And what does it mean to be subordinate, junior and inferior to the lien of plaintiff’s mortgage?

. . .

Lona Hunt: A. I’m not sure.

(Hunt Depo, P. 45 Ln. 25 – P. 46 Ln. 7).

Similarly, Ms. Hunt did not know the truth or accuracy of Paragraph 4 of the Complaint, which states that unknown spouses, heirs, devisees, etc. may have an interest in the subject property which is subordinate, junior and inferior to Plaintiff’s.

Mr. Rosen: Q. And in the next paragraph, paragraph 4, that in addition to all other defendants and it says, “Unknown spouses heirs, devisees, grantees, assignees, creditors, trustees, successors in interest or other parties claiming interest in the subject property by, through or against any said defendants, whether natural or corporate, who are not known to be alive or dead, dissolved or existing, are joined as defendants herein.” How did you know about those other specifically – how did you know that that was the case?

. . .

Lona Hunt: A. I don’t know.

Mr. Rosen: Q. Okay. It then says, “The claims of said parties are subject, subordinate and inferior to the interest of the plaintiff.” How did you know that that was correct?

. . .

Lona Hunt: A. I didn’t know.

(Hunt Depo, P. 46 Ln. 9 – P. 47 Ln. 3).

Paragraph 5 of Plaintiff’s Complaint states that Defendants, Mr. and Mrs. Redacted, “executed and delivered a mortgage securing payment of the note to JPMorgan Chase Bank, N.A.” Ms. Hunt did not know what that meant.

Mr. Rosen: Q. What does it mean securing payment of the note to JPMorgan Chase Bank, N.A., what does that mean?

Lona Hunt: A. That’s who had it. I’m not for sure.

(Hunt Depo, P. 48 Ln. 3-6).

Paragraph 5 further alleged that the mortgage mortgaged the property “then owned and in possession of the mortgagor(s).”

Mr. Rosen: Q. And how did you know that the property described in the mortgage was owned and in possession –or who owned it and who was in possession of it?

Lona Hunt: A. Fannie Mae.

Mr. Rosen: Q. How did you know that?

. . .

Lona Hunt: A. The Note.

Mr. Rosen: Q. So, just to clarify, I’m asking you how did you know who owned and was in possession of the property at the time of – at the time of origination?

Lona Hunt: A. Please repeat.

Mr. Rosen: Q. Sure. I’m asking how did you know who owned the property and who possessed the property at the time of origination?

Lona Hunt: A. By the note. I can’t look at the page.

Mr. Rosen: Q. Let’s take a look at the note. It’s attached to the complaint, Exhibit B. Can you show me where in the note it says who owned and possesses the property?

. .

Lona Hunt: A. Federal National Mortgage Association, the back page.

Mr. Rosen: Q. The back page it’s telling you who owns the property?

Lona Hunt: A. It says pay to the order of Federal National Mortgage Association.

(Hunt Depo, P. 48 Ln. 11 – P. 49 Ln. 15).

Here, Ms. Hunt further demonstrated her lack of competency to verify the Complaint as she was clearly confused with the concept of ownership of the property versus ownership of the note, despite the fact that Defendants’ counsel asked Ms. Hunt multiple times specifically about the property. Further, Ms. Hunt could not have verified paragraph 5 as she admitted that she did not even understand the term “mortgagor.”

Mr. Rosen: Q. Okay. What does it mean to be the mortgagor?

. . .

Lona Hunt: A. I’m not sure.

(Hunt Depo, P. 49 Ln. 16-23).

Paragraph 6 of Plaintiff’s Complaint states that “Plaintiff is the owner and holder of the note.” Although Ms. Hunt correctly identified the endorsement on the note as payable to Fannie Mae, she admitted that she had no idea what that meant.

Mr. Rosen: Q. How did you know that Fannie Mae is the owner and holder of the note?

Lona Hunt: A. The note where it’s stamped at the back saying that Fannie Mae – pay to the order of Fannie Mae in our system.

Mr. Rosen: Q. Okay. What does it mean to be an owner and holder of a note?

. . .

Lona Hunt: A. I’m not – I’m not quite sure. Don’t know.

(Hunt Depo, P. 49 Ln. 25 – P. 50 Ln. 9).

Paragraph 8 of Plaintiff’s Complaint states that “Plaintiff declares the full amount payable under the note and mortgage to be due.” Ms. Hunt did not know what that meant.

Mr. Rosen: Q. Okay. What does it mean in number 8 that the plaintiff declares the fill amount payable on the note and mortgage to be due?

. . .

Lona Hunt: A. I’m not sure.

(Hunt Depo, P. 51 Ln. 7-13).

Paragraph 9 of Plaintiff’s Complaint states in part that “[s]aid indebtedness has been accelerated pursuant to the terms of the subject note and mortgage.” Ms. Hunt also did not know what that meant.

Mr. Rosen: Q. What does indebtedness has been accelerated, what does that mean? It’s in paragraph 9, second sentence there.

. .

Lona Hunt: A. I’m not sure.

(Hunt Depo, P. 51 Ln. 18-22).

She later admits twice that she did not know whether a notice of default/acceleration letter had been sent.

(Hunt Depo, P. 58 Ln. 22 – P.59 Ln.12).

Paragraph 10 of Plaintiff’s Complaint alleges that Plaintiff is obligated to pay its attorneys a reasonable fee for their services and that Plaintiff is entitled to recover attorney’s fees to statute and the promissory note. Again, Ms. Hunt did not know that to be true.

Mr. Rosen: Q. How did you know the plaintiff is obligated to pay its attorneys a reasonable fee for their services?

Lona Hunt: A. I don’t know. Can you repeat what you mean?

Mr. Rosen: Q. Sure. I’m just asking paragraph 10, how do you know that plaintiff is obligated to pay its attorneys a reasonable fee for their services?

Lona Hunt: A. I don’t know.

Mr. Rosen: Q. And how do you know the plaintiff is entitled to recover its attorneys’ fees pursuant to Florida statute and the promissory note?

Lona Hunt: A. I’m not sure.

(Hunt Depo, P. 51 Ln. 24 – P. 52 Ln. 10).

Additionally, Ms. Hunt did not understand the term “deficiency judgment” found in Plaintiff’s pray for relief, the wherefore clause.

Mr. Rosen: Q. What is a deficiency judgment? In the wherefore clause it says deficiency judgment. What is that?

. . .

Lona Hunt: A. Not sure.

Some may argue that the terms which Ms. Hunt was unfamiliar with are “legal conclusions” and that she does not have to be familiar with those terms. However, this argument is preposterous! The document Ms. Hunt was verifying is a legal document, with legal terms to describe the factual allegations to which Ms. Hunt swore were true and correct. If Ms. Hunt does not understand the very basic terms of her employers business, she cannot possibly truthfully and accurately verify the allegations of the complaint and must not sign, under penalty of perjury, otherwise.

As a very astute judge once said to me, until someone goes to jail, nothing will change. It’s infuriating that banks continue to break the law. However, in this instance, no words can describe how outrageous this conduct is. Here Fannie Mae and Seterus, through their robo verifier, are breaking the very law with the same conduct that necessitated this particular law in the first place. It’s like a ponzi schemer, raising money to pay investors by ripping off new ones, or a drug dealer posting bond by raising money selling more drugs. Quite simply, if swearing under penalty of perjury, that you read something while later freely admitting, twice, that you did not, is not a crime, I don’t know anymore what is. If I did this, I’d expect to be charged with a crime but for the banks, I suspect this will just be treated as another “mistake” or “paperwork irregularity.” It is neither of those things. THIS IS A CRIME AND IT SHOULD BE PROSECUTED LIKE ONE, FROM THE HIGHEST LEVELS OF FANNIE MAE AND SETERUS, WHO ARE PUTTING ROBO-SIGNERS IN A POSITION TO COMMIT THEM. Here it is Pam Bondi and others, crystal clear proof that a crime has been committed. QUESTION IS – ARE YOU GOING TO DO ANYTHING ABOUT IT?

BANKING SCANDAL: banks RIG foreclosure settlements, MILLIONS kicked out of HOMES

It turns out the “robo-signing” of foreclosure affidavits is just the tip of the iceberg.

In what one judge called “robo-testimony,” falsely attested-to statements by bank document custodians have been submitted in courts around the country by banks trying to win judgments against delinquent credit card debtors.

Apparently, tens of millions of credit cards issued by banks have not been accompanied by good recordkeeping, either.

Chasing down delinquent borrowers in court requires original credit agreements and accurate payment histories to verify outstanding balances and claims.

As it turns out, banks aren’t providing them – either to the courts or to third-party debt collection companies that buy uncollected debts for pennies on the dollar.

As a result of these shoddy practices, judgments already granted to banks could be overturned and they could be sued by state attorney generals or pursued by the Consumer Financial Protection Bureau.

The same banks could even be potentially charged by the Justice Department under the Racketeer Influenced and Corrupt Organizations (RICO) Statutes for selling dubiously documented accounts to debt collection companies.

While some debtors will take comfort in what they read here, investors in banks may want to question how legal issues and regulatory investigations will impact their stocks.

Questionable bank documentation submitted to courts may be the reason JPMorgan Chase & Co. (NYSE: JPM) abruptly abandoned over 1,000 debt collection lawsuits in April 2011.

However, debtors whose pending cases were dismissed aren’t out of the woods yet. All of Chases’ suits were dismissed “without prejudice,” meaning Chase can re-file the cases in the future.

A Debt Collector’s Dirty Trick

The only relief long-delinquent borrowers have is the statute of limitations imposed by most states on debt collection.

Statutes of limitation, which are typically between two and 15 years, are by themselves no guarantee that debt collection agencies, which buy accounts from banks, won’t try to still collect.

Some debt collection companies entice delinquent borrowers who are beyond their statute of limitation requirements to make payments by offering to reduce the whole amount owed.

Their aim is to get the borrower to make even a single payment. It’s an old trick.

By paying anything on a debt that is past the statute of limitations, the debt is brought back to life again and the statute of limitations clock starts all over from the date of the new payment.

It’s why debtors are browbeaten and enticed to make payments through mailings, harassing calls, and “transfer of balance” offers for new credit cards, which requires old debts to be rolled into the new credit agreement.

The industry term for restarting the clock on old debts is called “re-aging.”

The Federal Trade Commission’s Bureau of Consumer Protection calls it illegal and abusive.

Last month the FTC and the Justice Department settled with one of the country’s biggest debt collection companies in a case with repercussions for the entire debt collection industry.

Asset Acceptance Capital Corp., which the FTC had charged with violations of federal law – including that it “failed to tell debtors they couldn’t be sued” when they tricked them into making payments to “re-age” old debts – was fined $2.5 million without admitting or denying wrongdoing.

The FTC, upon fining Asset Acceptance, announced additional enforcement actions are pending.

They are now joined by the Consumer Financial Protection Bureau, which has the authority to go after banks for abusive collection tactics.

Wells Fargo settles another robosigning lawsuit brought by shareholders not homeowners

Wells Fargo settles another robosigning lawsuit brought by shareholders not homeowners

Wells Fargo (WFC) settled another lawsuit in relation to alleged robosigning activity at the big bank.

This time, as opposed to a national settlement from Attorneys General, this $67 million settlement resolves a lawsuit brought by shareholders against the Wells Fargo board of directors.

“As a result of the alleged so-called “robo-signing” at Wells Fargo, the Federal Plaintiff alleges that the Federal Individual Defendants breached their fiduciary duty of loyalty owed to Wells Fargo and its stockholders,” the court filing said.

Wells Fargo spokesman Tom Goyda said “Wells Fargo and its directors are pleased to have resolved this matter.”

“We remain committed to our efforts to assist borrowers facing financial challenges and believe this settlement benefits the company, our customers and our shareholders,” he added.

As a result of the settlement, Wells Fargo will agree to some homeowner counseling and down-payment assistance.